- Our Story

- Publications & Resources

- Publications & Resources

- Publications

- IEEE Signal Processing Magazine

- IEEE Journal of Selected Topics in Signal Processing

- IEEE Signal Processing Letters

- IEEE Transactions on Computational Imaging

- IEEE Transactions on Image Processing

- IEEE Transactions on Information Forensics and Security

- IEEE Transactions on Multimedia

- IEEE Transactions on Signal and Information Processing over Networks

- IEEE Transactions on Signal Processing

- IEEE TCI

- IEEE TSIPN

- Data & Challenges

- Submit Manuscript

- Guidelines

- Information for Authors

- Special Issue Deadlines

- Overview Articles

- Top Accessed Articles

- SPS Newsletter

- SigPort

- SPS Resource Center

- Publications FAQ

- Blog

- News

- Dataset Papers

- Conferences & Events

- Community & Involvement

- Professional Development

- For Volunteers

- Information for Authors-OJSP

-

Home

ICASSP@50: A Recap [Conference Highlights]

Conversational Agents in the Era of Large Language Models

Conferences Events IEEE Signal Processing Magazine IEEE SPL Article IEEE TIFS Article IEEE TMM Article IEEE TSP Article Jobs in Signal Processing Lectures Machine Learning Seasonal Schools Signal Processing News SPM Article SPS Distinguished Lectures SPS Newsletter Article SPS Webinar SPS Webinars SPS Webinar Series Webinar webinars -

Our Story

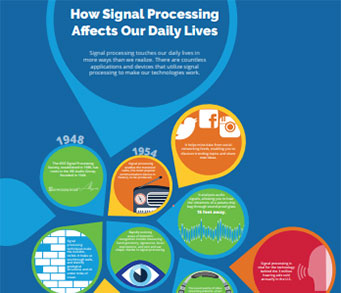

What is Signal Processing?

The technology we use, and even rely on, in our everyday lives –computers, radios, video, cell phones – is enabled by signal processing. Learn More » -

Publications & Resources

-

SPS Resources

- Signal Processing Magazine The premier publication of the society.

- SPS Newsletter Monthly updates in Signal Processing

- SPS Resource Center Online library of tutorials, lectures, and presentations.

- SigPort Online repository for reports, papers, and more.

- SPS Feed The latest news, events, and more from the world of Signal Processing.

-

SPS Resources

-

Conferences & Events

-

Community & Involvement

-

Membership

- Join SPS The IEEE Signal Processing Magazine, Conference, Discounts, Awards, Collaborations, and more!

- Chapter Locator Find your local chapter and connect with fellow industry professionals, academics and students

- Women in Signal Processing Networking and engagement opportunities for women across signal processing disciplines

- Students Scholarships, conference discounts, travel grants, SP Cup, VIP Cup, 5-MICC

- Young Professionals Career development opportunities, networking

- Get Involved

-

Technical Committees

- Applied Signal Processing Systems

- Audio and Acoustic Signal Processing

- Bio Imaging and Signal Processing

- Computational Imaging

- Image Video and Multidimensional Signal Processing

- Information Forensics and Security

- Machine Learning for Signal Processing

- Multimedia Signal Processing

- Sensor Array and Multichannel

- Signal Processing for Communication and Networking

- Signal Processing Theory and Methods

- Speech and Language Processing

- Technical Working Groups

- More TC Resources

-

Membership

-

Professional Development

-

Professional Development

- Signal Processing Mentorship Academy (SigMA) Program

- Micro Mentoring Experience Program (MiME)

- Distinguished Lecturer Program

- Distinguished Lecturers

- Distinguished Lecturer Nominations

- Past Lecturers

- Distinguished Industry Speaker Program

- Distinguished Industry Speakers

- Distinguished Industry Speaker Nominations

- Industry Resources

- IEEE Training Materials

- Jobs in Signal Processing: IEEE Job Site

-

Career Resources

- SPS Education Program Educational content in signal processing and related fields.

- Distinguished Lecturer Program Chapters have access to educators and authors in the fields of Signal Processing

- Job Opportunities Signal Processing and Technical Committee specific job opportunities

- Job Submission Form Employers may submit opportunities in the area of Signal Processing.

-

Professional Development

-

For Volunteers

-

For Board & Committee Members

- Board Agenda/Minutes* Agendas, minutes and supporting documentation for Board and Committee Members

- SPS Directory* Directory of volunteers, society and division directory for Board and Committee Members.

- Membership Development Reports* Insight into the Society’s month-over-month and year-over-year growths and declines for Board and Committee Members

-

For Board & Committee Members

Popular Pages

Today's:

- Information for Authors

- ICASSP@50: A Recap [Conference Highlights]

- (ICME 2026) 2026 IEEE International Conference on Multimedia and Expo

- IEEE JSTSP Special Issue on Advanced AI and Signal Processing for Low-Altitude Wireless Networks

- IEEE Transactions on Information Forensics and Security

- Conference Call for Papers

- IEEE Transactions on Image Processing

- IEEE Transactions on Multimedia

- (CAI 2026) IEEE Conference on Artificial Intelligence 2026

- IEEE Signal Processing Letters

- Guidelines

- Information for Authors-SPL

- Building Bridges for Our Professional Future [President’s Message]

- Editorial Board Nominations

- IEEE Transactions on Signal Processing

All time:

- Information for Authors

- Submit a Manuscript

- IEEE Transactions on Image Processing

- IEEE Transactions on Information Forensics and Security

- IEEE Transactions on Multimedia

- IEEE Transactions on Audio, Speech and Language Processing

- IEEE Signal Processing Letters

- IEEE Transactions on Signal Processing

- Conferences & Events

- IEEE Journal of Selected Topics in Signal Processing

- Information for Authors-SPL

- Conference Call for Papers

- Signal Processing 101

- IEEE Signal Processing Magazine

- Guidelines

Last viewed:

- IEEE JSTSP Special Issue on Advanced AI and Signal Processing for Low-Altitude Wireless Networks

- Editorial Board

- SPS Scholarship Program

- ICASSP@50: A Recap [Conference Highlights]

- IEEE Signal Processing Magazine

- Empirical Wavelets

- Building Bridges for Our Professional Future [President’s Message]

- IEEE TCI Special Section on Computational Imaging using Synthetic Apertures

- Call for Proposals: (SLT 2026) 2026 IEEE Workshop on Spoken Language Technology

- For Volunteers

- Editorial Board Nominations

- On the Efficient Design of Stacked Intelligent Metasurfaces for Secure SISO Transmission

- IEEE Transactions on Image Processing

- Practical Public Template Attack Attacks on CRYSTALS-Dilithium With Randomness Leakages

- (SPAWC 2025) 2025 IEEE Workshop on Signal Processing and Artificial Intelligence for Wireless Communications

Financial Signal Processing and Machine Learning. Wiley - IEEE Press. 2016

You are here

Newsletter Menu

Newsletter Categories

Top Reasons to Join SPS Today!

1. IEEE Signal Processing Magazine

2. Signal Processing Digital Library*

3. Inside Signal Processing Newsletter

4. SPS Resource Center

5. Career advancement & recognition

6. Discounts on conferences and publications

7. Professional networking

8. Communities for students, young professionals, and women

9. Volunteer opportunities

10. Coming soon! PDH/CEU credits

Click here to learn more.

News and Resources for Members of the IEEE Signal Processing Society

Financial Signal Processing and Machine Learning. Wiley - IEEE Press. 2016

A.N. Akansu, S.R. Kulkarni and D.M. Malioutov, Eds., Financial Signal Processing and Machine Learning

ISBN: 978-1-118-74567-0

URL: http://www.wiley.com/WileyCDA/WileyTitle/productCd-1118745671.html

Description

The modern financial industry has been required to deal with large and diverse portfolios in a variety of asset classes often with limited market data available. Financial Signal Processing and Machine Learning unifies a number of recent advances made in signal processing and machine learning for the design and management of investment portfolios and financial engineering. This book bridges the gap between these disciplines, offering the latest information on key topics including characterizing statistical dependence and correlation in high dimensions, constructing effective and robust risk measures, and their use in portfolio optimization and rebalancing. The book focuses on signal processing approaches to model return, momentum, and mean reversion, addressing theoretical and implementation aspects. It highlights the connections between portfolio theory, sparse learning and compressed sensing, sparse eigen-portfolios, robust optimization, non-Gaussian data-driven risk measures, graphical models, causal analysis through temporal-causal modeling, and large-scale copula-based approaches.

Key features:

- Highlights signal processing and machine learning as key approaches to quantitative finance.

- Offers advanced mathematical tools for high-dimensional portfolio construction, monitoring, and post-trade analysis problems.

- Presents portfolio theory, sparse learning and compressed sensing, sparsity methods for investment portfolios. including eigen-portfolios, model return, momentum, mean reversion and non-Gaussian data-driven risk measures with real-world applications of these techniques.

- Includes contributions from leading researchers and practitioners in both the signal and information processing communities, and the quantitative finance community.

Open Calls

| Nomination/Position | Deadline |

|---|---|

| Call for Nominations for the SPS Chapter of the Year Award | 15 October 2025 |

| Call for Papers for 2026 LRAC Workshop | 22 October 2025 |

| Submit Your 2026 ICASSP Workshop Paper | 22 October 2025 |

| Submit a Proposal for ICASSP 2030 | 31 October 2025 |

| Call for Project Proposals: IEEE SPS SigMA Program - Signal Processing Mentorship Academy | 2 November 2025 |

| Submit Your Proposals for 2026 Member-Driven Initiatives | 21 November 2025 |

| IEEE Signal Processing Society Annual Election Opens on 17 October | 4 December 2025 |

Society News

- 2016 annual reporting and rebate requirements: financial reporting due 28 February; meeting and officer reporting due 15 March

- Call for Nominations: Chief Editor, SigPort and Chief Editor, Resource Center

- SPS Technically Sponsors New Publication in 2017: IEEE L-CSS

- Featured News Around IEEE: IEEE Smart Grid Newsletter

- IEEE-USA Offers Free e-Books to Members in December and January

- Orientation Webinars for New Members; Guest Speakers for January and February

- IEEE Launches New 5G Initiative and Seeks Volunteers

- IEEE Women in Engineering News: WIE ILC 2017, Call for Award Nominations, Scholarship Opportunities

- New Online Submission Process for Geographic Unit Formations

- Call for Nominations: IEEE Technical Field Awards

- Reminder call for Nominations: IEEE Fellow Class of 2018: Deadline 1 March

- Call for Nominations for Editors-in-Chief

- Call for Officer Nominations: President-Elect, Vice President-Conferences and Vice President-Publications

- Signal Processing Society Members Receive 2017 IEEE Medals

- 2016 Signal Processing Society Award Recipients

- Signal Processing Conferences

- 57 Signal Processing Society Members Elevated to Senior Member

- Job Opportunities in Signal Processing

Member Highlights

Conferences & Events

Education & Resources

Technical Committee News

PhD Theses

- Zhou, Yihang (State University of New York at Buffalo), “Application of compressed sensing in quantitative magnetic resonance imaging” (2016)

- Corso, Nicholas Giovanni (University of California, Berkeley), “Sensor Fusion and Online Calibration of an Ambulatory Backpack System for Indoor Mobile Mapping” (2016)

SPS Social Media

- IEEE SPS Facebook Page https://www.facebook.com/ieeeSPS

- IEEE SPS X Page https://x.com/IEEEsps

- IEEE SPS Instagram Page https://www.instagram.com/ieeesps/?hl=en

- IEEE SPS LinkedIn Page https://www.linkedin.com/company/ieeesps/

- IEEE SPS YouTube Channel https://www.youtube.com/ieeeSPS

Home | Sitemap | Contact | Accessibility | Nondiscrimination Policy | IEEE Ethics Reporting | IEEE Privacy Policy | Terms | Feedback

© Copyright 2025 IEEE - All rights reserved. Use of this website signifies your agreement to the IEEE Terms and Conditions.

A public charity, IEEE is the world's largest technical professional organization dedicated to advancing technology for the benefit of humanity.